by Majid Habibi | Jul 19, 2024 | Finance, Homeownership

Saving for a down payment on a home can be challenging but, with careful planning and discipline, this important milestone will become much more easily achievable. Following are 10 helpful tips to get you started on your homeownership journey as soon as possible. 1....

by Majid Habibi | Jul 5, 2024 | Blog

College and university residence spaces and local rental opportunities are tight in many areas with concentrated amounts of student population. That’s why it may be a great idea to consider buying a home for your child and their friends/roommates to live in while...

by Majid Habibi | Jun 21, 2024 | Blog, Homeownership

Mortgage fraud is a serious issue in Canada that is becoming extremely sophisticated, and can lead to significant financial loss and loSigns to Look for to Help Prevent Mortgage Fraud 1. Work with reputable professionals. Choose lenders, mortgage brokers/agents and...

by Majid Habibi | Jun 7, 2024 | Blog, Homeownership

Private mortgage options have become increasingly more popular thanks to stringent stress test mortgage qualification rules required by traditional lenders such as banks, increased inflation and higher interest rates. It’s just one more option your mortgage agent can...

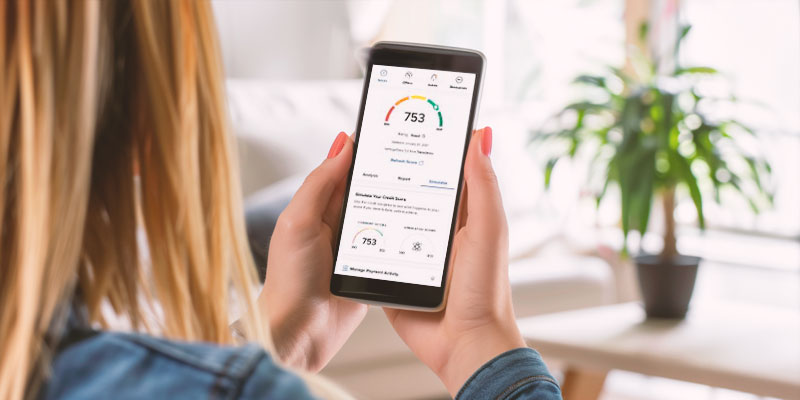

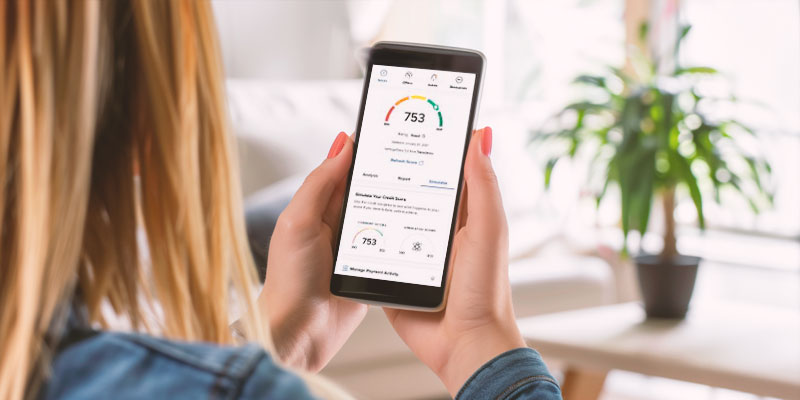

by Majid Habibi | May 17, 2024 | Blog, Finance

When it comes to improving your credit score, your mortgage agent can be an invaluable ally. A higher credit score not only qualifies you for better mortgage rates, but it also opens the door to a variety of financial opportunities. Let’s face it, sometimes life...

by Majid Habibi | May 3, 2024 | Blog, Finance

Real estate has proven to be a sound long-term investment. If you’re thinking about buying an investment property, consulting with your trusted mortgage agent is a terrific place to start. Your agent can play a crucial role by providing valuable expertise throughout...

by Majid Habibi | Apr 19, 2024 | Blog, Homeownership

April 2024 has been an active month for news impacting mortgage borrowers! The 2024 federal budget contained some benefits for first-time homebuyers, which is a step in the right direction. In addition, the federal government announced big plans the mortgage industry...

by Majid Habibi | Apr 5, 2024 | Blog, Homeownership

Saving for a down payment is often one of the greatest barriers to homeownership. Fortunately, a First Home Savings Account (FHSA) encourages Canadians to intentionally plan ahead for your entrance into the housing market. First introduced by the federal government...

by Majid Habibi | Mar 15, 2024 | Blog, Homeownership

Buying your first home is extremely exciting, but it also takes a lot of planning, including building a realistic budget that helps ensure you can afford to carry all the expenses that come along with homeownership. Here are the key homebuying costs to include in your...

by Majid Habibi | Mar 8, 2024 | Blog, Mortgage

For many homeowners, securing a mortgage is a significant financial milestone. But, it’s just as important to regularly review and optimize that mortgage. This is where your mortgage agent becomes even more invaluable – proactively looking out for your best interests...